SCRD Budget Wrap Up

After two days of discussions, the Sunshine Coast Regional District (SCRD) Board wrapped up the 2025 Budget process with adoption of the budget set to take place in February.

The three main focuses for this year’s budget are:

- Capacity – Previous year’s budgets have seen excess uncompleted projects carried forward. This is being addressed to ensure that there is enough staff capacity to complete projects in a timely manner.

- Underfunding – The SCRD continues to deal with decades of underfunding of major services including water,solid waste and parks which needs to be addressed.

- Service Levels – This budget is focused on maintaining reliable service levels in key areas such as water with an eye to future community needs.

This year, projects being considered through the budget process have been broken down into three categories;

- Mandatory Projects (Must do) – Projects that must proceed in the budget year due to imminent asset failure (with a defined consequence), regulatory compliance or safety requirements.

- Strategic (Should do) – Directly relates to Board Strategic Focus Areas of water stewardship or solid waste solutions, a Board Directive, and/or is required because of policy.

- Discretionary (Could do) – Projects that do not meet any of the criteria for Mandatory or Strategic classification.

The Board’s focus has been on moving forward mandatory projects and those strategic projects which will maintain service levels with the potential to increase service levels in the future.

A sample of these projects is below.

Mandatory Projects

- Upgrades to the Chapman Water Treatment Plant

- Soames Creek Monitoring Compliance

- Several projects focused on health and safety

- Noxious weed removal at John Daley Park

- Increased information technology data storage

Several projects are part of the SCRD Board’s Strategic Plan and focus on two main service areas, Water Stewardship and Solid Waste Solutions. These include;

- Design and permitting for a treatment plant for the Gray Creek water source

- Construction of the Langdale Well Field

- Permitting associated with Siphons at Chapman and Edwards Lakes.

- Control System upgrades at water treatment plants, pump stations and reservoirs across all water systems

- Reservoir maintenance in the Regional and South Pender water systems

- Continued work and engagement on the Solid Waste Management Plan to explore future waste disposal options on the Sunshine Coast

- Resources to support the reservoir projects with the shishalh Nation

Several projects are required to maintain service levels and plan for future demand. These include;

- Most SCRD services require a base budget lift to adjust to inflation and increased cost of goods and services

- Budget for Transit Expansion priorities through 2025

- Major project is required to repair trails and bridges at Cliff Gilker Park

- Upgrades to Mason Road works yard to prepare for electric buses in the Region

- Pressure release valves to optimize water flow for the Church Road Well Field

- Implementation of the Firefighter Compensation Action Plan

- Several vehicle replacements

- Ongoing operations and maintenance at wastewater treatment facilities

In addition to the projects above, the SCRD Board is also moving forward with over $1.8 million in funding to local community partners including the Sechelt and Gibsons Libraries, Sunshine Coast Community Services, Pender Harbour Health Centre and Sunshine Coast Tourism.

Preliminary Property Tax Rates

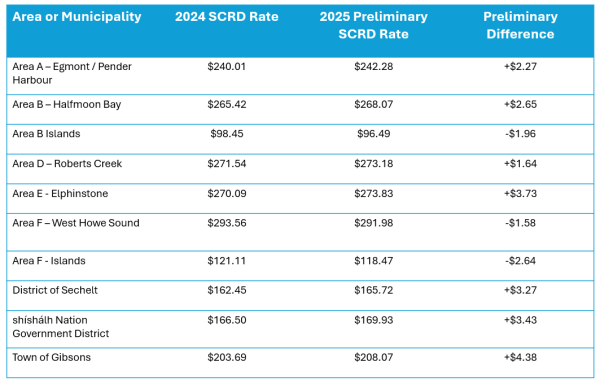

After Round Two Budget, the following are the preliminary average SCRD tax rates per $100,000 of assessed value of homes.

The figures below are not final and only cover the SCRD portion of your tax bill. If you do not know which area or municipality your home is in, you can search your address via the map linked here.

Taxation Information per $100k of assessed home value

Calculating the preliminary SCRD portion of your tax bill

You can calculate the preliminary 2025 SCRD portion of your tax bill in three steps:

Step 1 – Take the assessed value of your home which can be found here at BC Assessment.

Step 2 – Divide the assessed value of your home by $100,000.

Step 3 – Multiply that figure by the 2025 preliminary amounts outlined above based off your Electoral Area or Municipality.

For example: If your home is worth $800,000 and the preliminary 2025 SCRD tax rate is $200 then the SCRD portion of your tax bill would be 8 x $200 = $1600.

Staying Informed

SCRD Directors will be providing outreach and presentations in their respective areas to ensure that the community can speak directly to those who are making decisions on this year’s budget. These community conversations will continue throughout the budget process, up until the adoption of the financial plan in mid-February.

If you are a member of a community group or organization that would like a presentation from your elected representative, their contact information can be found at www.scrd.ca/electoral-areas-and-municipalities/.

The best way to stay informed on Budget 2025 and ask questions at any time is at letstalk.scrd.ca/budget.